By Seeking Alpha

Hellas Gold S.A. has filed a non-judicial request for payment of approximately €750 million with the Hellenic Republic, arising from delays in the issuance of permits for the Skouries project-The whole Smelter dispute has nothing to do with the granting of the two outstanding permits for the Skouries mine-I am glad that Eldorado Gold is increasing the pressure here. It is the first step before initiating legal proceedings. Maybe this attitude will push George Stathakis to reconsider.

Investment Thesis

Eldorado Gold Corp. (NYSE:EGO) is a mid-tier Canadian gold miner with several international operations. The company attempted a turnaround after the sale of its Chinese assets for nearly $1 billion, and recently acquired 100% of Integra Gold Corp. (OTCQX:ICGQF) (with its flagship project called Lamaque in Quebec), expected to be producing commercially early next year.

It is no secret – the company is struggling, even more now, with a never-ending dispute with the leftist SYRIZA government of Greece and some additional technical issues in its major producing mine in Turkey called Kişladağ. Adding more salt to the open wound, the price of gold has been weakening against the strong dollar.

Those sharp technical headwinds, in addition to a weakening price of gold to barely above $1,200 per ounce, resulted in a negative impact on the stock price, which is now trading below $1, and turns the stock to an “NYSE noncompliant,” with the risk of delisting if the company is not implementing a reverse split within a 6-month grace period. Please read my preceding article on this subject here.

The Greek Saga – Is the Greek Government acting above the law?

1 – September 14, 2017: Arbitration proceeding initiated by the Greek government

As I said in a preceding article, I will not open the long and acrimonious dispute history between Eldorado Gold and the Greek government; it would be too long. I will speak about the recent episodes instead, and will clarify the best as I can what is going on.

Note: The Skouries mine has been placed in care & maintenance. Development CapEx for 2018 will be reduced to $20 million in 2018.

1 – On September 14, 2017, Eldorado Gold received an arbitration notice from the Greek government.

… The arbitration notice alleges that the Technical Study for the Madem Lakkos Metallurgical Plant for treating Olympias and Skouries concentrates in the Stratoni Valley, submitted in December 2014, is deficient and thereby is in violation of the Transfer Contract and the environmental terms of the project. The Company is highly confident that the subject Technical Study is robust and consistent with the Transfer Contract, the Business Plan and the approved environmental terms of the project.

In short, the problem is about the way Eldorado Gold intends to process its ore in its Madem-Lakkos metallurgical plant. The process is called “flash smelting” pyrometallurgical technology, which is a technology developed by a Finnish company called Outotec (OTC:OUKPF). People opposed to the project are arguing that the technique cannot be applied in Greece, as the arsenic content is too high.

Eldorado Gold replied that the method had been thoroughly tested and proven by the specialized Finnish company Outotec, and the Greek Council of State has repeatedly accepted the favorable opinion.

The Greek government has raised significant obstacles from the very beginning of this controversial project despite having been rebuffed many times by the High Court. It rejected two technical studies, reviewed permits that have been already issued, and delayed – by up to 31 months – the issuance of new licenses by many months.

The technical study for the construction of the metallurgy plant, which has been rejected last November by the Ministry of Environment (MoE), was submitted on December 22, 2014.

2 – April 4, 2018: The Panel’s ruling denies the Greek State’s motion in favor of Eldorado Gold

On April 4, 2018, Eldorado Gold confirmed that the Arbitration Panel (the “Panel”) in Greece had issued its ruling concerning the arbitration initiated by the Greek State.

The Panel’s ruling rejects the Greek State’s motion that the technical study for the Madem-Lakkos metallurgy plant for treating Olympias and Skouries concentrates, as submitted by the Company’s Greek subsidiary Hellas Gold S.A. in December 2014, was in breach of the provisions of the Transfer Contract.

The Transfer Contract is the document dated December 12, 2003, whereby Hellas Gold originally acquired the Kassandra assets, comprised of Olympias, Skouries, and Stratoni, in the Halkidiki region of Greece and was ratified by Greek National Law No 3220/2004.

3 – March 29, 2018: Eldorado Gold updated its Technical Report

To ease the concerns of the Greek government about the project, Eldorado Gold updated the Skouries Technical Report and filed it on March 29, 2018.

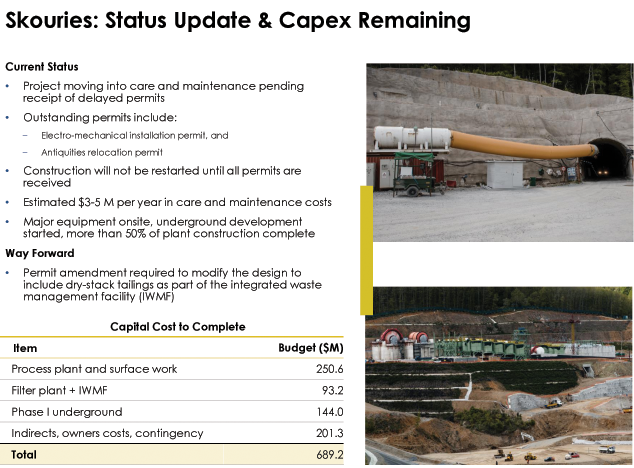

The updated design reflects some of the best available control technology, a dramatically reduced environmental footprint, and utilizes filtered dry stack tailings. The estimated capital cost is $689.2 million (including $87 million in contingency) to fully develop both the open pit and Phase I of the Skouries underground, resulting in an extra expense of about $100-120 million compared to the initial Technical Report.

(Source: EGO Presentation)

4 – May 22, 2018: We learn from Reuters that Greece aims to resolve a long-standing standoff with Canada’s Eldorado Gold

The article said that Greek Energy minister George Stathakis discussed the ruling with workers from Eldorado’s Greek unit. The energy ministry quoted Stathakis as saying:

The main aim is to reach an agreement in the coming weeks within the spirit of the arbitration ruling

The MoE did not specify what such an agreement would involve, but indicated that the arbitration ruling meant that Greece had to make sure that Eldorado will produce pure gold, silver, and zinc in the country.

However, the government wanted the miner to undertake “specific commitments,” including a timetable for when it will submit pending reports on the metallurgy plant.

5 – August 21, 2018: The Greek Ministry of the Environment has granted “One of the outstanding licenses for the mining and processing of gold in Northeastern Halkidiki.”

The Ministerial Decision is about the adoption of Appendix 5 concerning the technical study of the new enrichment plant at Madem Lakkos. The competent ministry was forced to proceed with the granting of this approval, following an appeal from the company to the Council of State (“CoS). The cause of this appeal to the Supreme Administrative Court was the rejection in 2016 by the then environment minister, George (Skourletis,) of the technical study for the metallurgical plant of Madem-Lakkos. However, this approval is not enough to allow the re-establishment of the Skouries enrichment plant, since the adoption of Appendix 5 concerns the metallurgical plant at Madem-Lakkos that is expected to operate after 2020.

This decision implies that the concentrate from Skouries, where an enrichment plant has not been constructed because no routine licenses haven’t been issued, will be soon granted?

For those who can read Greek, the approval can be found here (dated 9/8/2018).

However, the article indicated above was changed a little later to clarify the situation.

There were appeals of “Hellenic Gold” to the CoE, by which decisions 217/2016, 218/2016 and 221/2016 were issued. On November 9, 2017, “Ellinikos Xrysos” asked the CoE to check whether the administration complied with decision 221/2016.

According to the minutes of the meeting of 11/2018, the CoE has ruled that the administration failed to comply with this judgment and was asked to do so within three months of the notification of the minutes mentioned above.

However, this approval concerns the enrichment plant at Madem Lakkos, where the mining center of Ellinikos Xrysos will be built after 2020, including the gold and silver copper metallurgy.

6 – September 18, 2018: Hellas Gold S.A. has filed a non-judicial request for payment of approximately €750 million, or ~US$880 million, with the Hellenic Republic, arising from delays in the issuance of permits for the Skouries.

According to Yahoo:

The Application requests payment of approximately €750 million for damages suffered by the Company arising from delays in the issuance of permits for the Skouries project, including damages for out of pocket costs and loss of profits. The Application is a non-judicial request for payment and does not initiate legal proceedings.

George Burns, Eldorado Gold’s President and CEO said, “The Application represents a good-faith attempt to resolve the matter with the Greek State as it relates to costs incurred resulting from permit delays to our Skouries project. Eldorado has always acted in a manner consistent with finding a mutually-agreeable solution to responsibly developing Skouries. We hope that this matter can be resolved in an amicable manner without needing to go down the route of arbitration.”

Commentary

The leftist government of Greece is acting against the law, in my opinion only. The whole dispute has nothing to do with the granting of the two outstanding permits for the Skouries mine, and the MoE has failed to deliver them by acting against its own rules (abuse of power).

This action is even more damaging knowing that it comes from the place where democracy was supposedly born. Cleisthenes must be rolling in his grave by now.

The Skouries outstanding permits are just routine installation permits.

The dispute is related to the metallurgical plant of Madem-Lakkos and the rejection by the MoE (twice) of the technical study presented by Eldorado Gold.

However, Eldorado Gold has indeed claimed in September 2017 that the MoE cannot refuse technical approval to a project that was already environmentally approved. The MoE was forced to explain why it denied the study and what spells “adequacy”:

a) the technical adequacy of the technical study for the metallurgical unit, b) the technical reasons for which it was returned to the company, c) the reasons for which the company’s remedy appeal was denied.

The MoE used two points to reject the project (serious flaws, it says) in compliance with the State Council ruling. It said:

1 – Inadequate information is provided on the management of the highly toxic off-gases and fugitive emissions inside the plant which are dangerous for the health and safety of the workers. Due to the extremely high arsenic content of the Olympias concentrate, more than 20.000 tons of arsenic will vaporize on a yearly basis.

2 – The tests conducted by Outotec at its Pori facility result in an intermediate product, a new “concentrate” derived from the flash smelter matte and not metallic gold, silver and copper. The ministry stresses the fact that the production of pure metals is an explicit obligation of Eldorado under its contract with the Greek state and a fundamental term of the environmental permit.

The concerns are about the smelter’s arsenic emissions due to the ore quality of the deposit in Olympia (high-arsenic pyrite concentrate mainly from Olympias, not Skouries which is arsenic-free deposit) that will be processed (arsenic content of 8%) is the “apparent” issue.

However, it is not the “fundamental/political” one, which is that the SYRIZA government represents the minority group that doesn’t want a gold mine in the Halkidiki region no matter what.

The new government has been elected on the promise that it will cancel the project, and despite the financial cost and over 2,000 workers who lost their job in a country struggling with a moribund economy, it continues to stop the Skouries mine from being completed and lied about it (see #4 above).

Again, nothing is directly related to the two secondary permits that forced Eldorado Gold to put the Skouries mine in care & maintenance. Even so, the “flash smelting issue” was the reason behind it anyway:

- Electro-mechanical installation permit

- Antiquities relocation permit

Note: Technically, the antiquities relocation permit is not given by the MoE but by the Central Archaeological Council. The CAC has correlated its decision with the approval of the technical study for the metallurgical plant.

The MoE was obligated to deliver these permits within a specified period and failed to do it. Eldorado Gold has three lawsuits pending about this issue.

The real issue is political, as I said. George Stathakis (SYRIZA) is refusing to let it go despite all legal reasons to do it. He is representing a group politically charged against the projects, and is blocking these secondary permits arbitrarily to prevent the company from completing the project.

Conclusion

I am glad Eldorado Gold is increasing the pressure here. It is the first step before initiating long-overdue legal proceedings. Maybe this attitude will push George Stathakis to reconsider his unsustainable position and finally grant the Skouries permits? Above all, it starts a friendly dialogue and a willingness to compromise.

I wonder how Prime Minister Alexis Tsipras could have justified this retrograde business attitude at the recent Thessaloniki International Exhibition Centre:

The signs that Greece’s economy is turning a corner and is on the verge of exiting the crisis are multiplying, Prime Minister Alexis Tsipras said in an article in the ‘European Business Review 20 Years Anniversary Celebrating Edition: Special Report on Greece‘ under the headline “2018 will be a milestone for Greece and the Greek economy.”

Public property will be upgraded and exploited with the involvement of the private sector, with the aim of creating jobs and generating added value for local communities,

Disclosure:I am/we are long EGO.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I trade EGO regularly and own also a long-term position below $1.

Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.