Unusual governance structure has resulted in ‘management deadlock’ says former chairman

By Sam Jones in London and Kerin Hope in Athens, Financial Times

Shareholders have triggered a proxy battle for control of Greece’s largest construction company, Ellaktor, in a contest pitching powerful local business clans against international investors and bankers that is likely to be seen as a test of Greece’s economic openness as the country recovers from its devastating financial crisis.

Ellaktor’s chairman and vice-chairman Anastasios and Dimitrios Kallitsantsis resigned on Wednesday, setting in motion a carefully choreographed campaign that aims to muster support from international investors and dismiss the rest of the Ellaktor board at the annual meeting on June 29.

While the post-crisis Greek economy has grown, Ellaktor — a sprawling conglomerate responsible for everything from running motorways, wind farms and sewage works to building the Acropolis Museum in Athens — has languished.

Ellaktor has lost more than €370m in the past five years and has not paid a dividend since 2010. The company, listed in Athens, has seen its share price halve in the same period, and now trades at a significant discount to its peers. Its core construction division reported an margin on earnings before interest, tax, depreciation and amortisation of just 1.8 per cent on revenues of €1.5bn last year. Lucrative public infrastructure contracts that Ellaktor enjoyed in an era of high EU-funding and government largesse have dried up, while the group has struggled with projects outside Greece against fierce local competition in the Balkans.

The company did not return calls and emails for comment.

Anastasios Kallitsantsis and his backers — known as the Kilo Group, who have dubbed themselves “Change4Ellaktor” and who control an estimated 12 per cent of Ellaktor’s shares — say the company’s unusual structure has inhibited reform and accuse fellow directors of in effect running each of Ellaktor’s divisions as their own personal “kingdoms”.

The proxy fight will turn Ellaktor into a battleground between some of Greece’s most powerful business families.

Among the directors the Kallitsantsis’ and their backers wish to remove are Leonidas Bobolas and his sister Maria, scions of the Bobolas clan — media magnates and property developers in Greece and the Balkans.

The proposals also aim to sideline Ellaktor’s co-vice chairman and major shareholder, Dimitrios Koutras, one of the most prominent figures in the Greek construction industry. Mr Koutras and the Bobolas family together control 25 per cent of Ellaktor.

The Kilo Group has retained Rothschild in London to drum up support from international investors and potentially enlist hedge funds keen to exploit activist opportunities to help force through their proposals at the AGM.

Just over 50 per cent of Ellaktor shares are at present held by investors from outside Greece, they estimate.

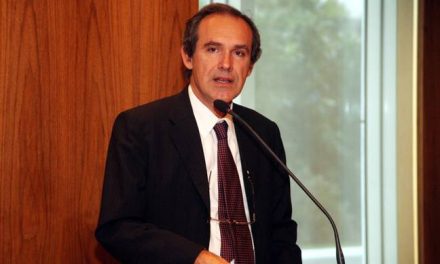

The group’s nominees to the board include a clutch of former investment bankers and Greek financial-sector insiders, among them George Provopoulos, former governor of the Bank of Greece and member of the European Central Bank’s governing council.

A presentation for a proxy campaign prepared by the Kilo Group, and seen by the Financial Times, highlights Ellaktor’s unorthodox governance structure: the company has no group chief executive, chief finance officer, chief operating officer or chief legal officer.

The presentation said this has resulted in “complete management deadlock”, with each division of the business being in effect run separately by board members and factions of shareholders backing them.

The Kilo Group’s objections to Ellaktor’s current position also reveal historic boardroom disagreements over specific elements of company strategy, particularly in an area of particular personal financial interest to Anastasios Kallitsantsis.

Ellaktor’s current board has consistently pushed for the sale of its 64.5 per cent stake in the wind farm business Eltech Anemos, one of the group’s highest margin areas of business. Mr Kallitsantsis, who oversees the group’s renewable operations, personally owns a further 7 per cent stake in Eltech Anemos.

The Kilo Group plan proposes to make wind farming the new “core” of Ellaktor’s business in the long term.

But Greek industry insiders are sceptical about such plans. Margins in the renewables sector — and wind farms in particular — have been shrinking after a spate of projects involving international investors has threatened to cause a glut in renewables supply across Greece.

Other, less long-term motives may be at play behind the plans to attract foreign investors keen to capitalise on Greek corporate opportunities and aid the Kilo Group in ousting rival Greek business families from Ellaktor’s board, however.

A particularly attractive prize for foreign investors would be wresting control of Ellaktor’s concessions business — under the current oversight of Mr Koutras — and with it, the lucrative Attiki Odos toll road that surrounds central Athens.

Attiki Odos has €213m of cash on its balance sheet — a hefty short-term windfall for new investors should the Kilo Group’s proposed plans to rationalise Ellaktor’s capital structure come to fruition.