A new report confirm that states with lower taxes and reasonable levels of government spending have stronger economies

Need proof that tax cuts promote economic growth? Look to the states

By Akash Chougule

As Congress debates reforming the federal tax code for the first time in more than 30 years, the states continue to confirm what too many in Washington are denying: Taxes matter for economic growth.

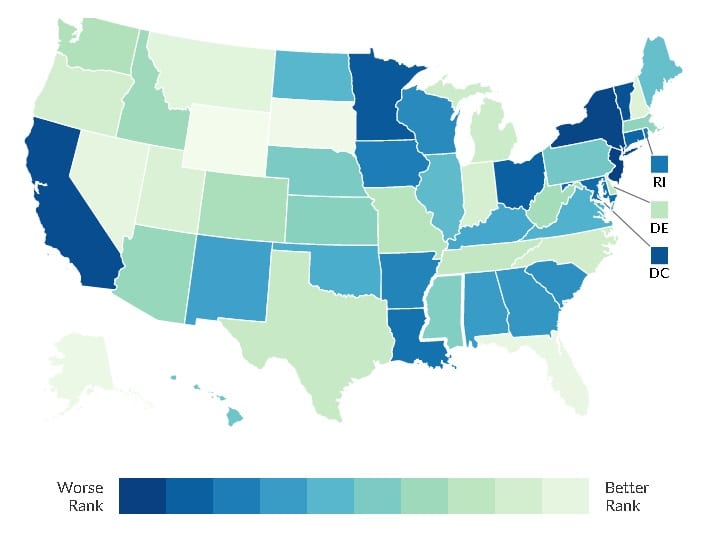

A new report released this week by the Tax Foundation – along with assessment of states’ fiscal health, economic performance, and population changes – confirm that states with lower taxes and reasonable levels of government spending have stronger economies and are more attractive for businesses and individuals.

The State Business Tax Climate Index is an annual ranking of state tax systems and how well they are structured to promote economic growth. The usual suspects found themselves at the top as Wyoming, South Dakota, Alaska, Florida, and Nevada took the top five spots. None of these states levies a tax on individual income (essentially, a tax on work). Wyoming and South Dakota also do not levy a corporate income tax, which unsurprisingly makes them attractive places to grow or start a business.

Of the top 10 states overall, eight forego imposing at least one major broad-based tax. Montana and New Hampshire – ranked sixth and seventh respectively – have no sales tax (New Hampshire also has no individual income tax), and Oregon at number 10 also has no state sales tax. The only exceptions are Utah and Indiana, ranked eighth and ninth respectively, which have low taxes across the board and several other economic advantages such as reasonable regulatory environments and a right-to-work law.

Just as important as the tax climate is the other side of the government finance coin: spending. Reckless spending crowds out private investment and creates economic uncertainty. And contrary to what some believe, higher taxes do not mean better fiscal condition – rather, low-tax states that keep spending in check are in the best overall fiscal condition.

The Mercatus Center at George Mason University found that Florida, North Dakota, South Dakota, Utah, and Wyoming were the top five states for overall fiscal health, meaning they had higher levels of cash, low unfunded pension liabilities, and strong operating positions.

These tax and fiscal rankings mean more than just numbers on paper – they directly impact economic growth and thus people’s wellbeing, as evidenced by the correlation to states’ economic performance. According to the American Legislative Exchange Council’s “Rich States, Poor States” report, the top 10 states for economic growth (looking backward) were Texas, North Dakota, Washington, Utah, Colorado, Oklahoma, Oregon, South Dakota, North Carolina, and Montana. The average overall ranking of these 10 states on the Tax Foundation list is 11.5. On the Mercatus fiscal list, it is 14.1.

Looking forward, the top 10 states for economic outlook are Utah, Indiana, North Carolina, North Dakota, Tennessee, Florida, Wyoming, Arizona, Texas, and Idaho. Again, the average ranking of these states for tax climate is 13.1. On the Mercatus list, it is 11.6.

The correlation goes in the opposite direction, too. Big-government, high-tax, reckless-spending states such as Vermont, California, New York, and New Jersey find themselves at or near the bottom of tax climate and fiscal health rankings, as well as the bottom in economic outlook.

Finally, there is perhaps no clearer way to assess what works and what doesn’t than by watching people vote with their feet. IRS and Census data collected by HowMoneyWalks.com makes clear that people are leaving high-tax, fiscally-reckless states such as New York, New Jersey, and California and flocking toward pro-growth environments such as Texas, Florida, and North Carolina.

Since 1992, Texas has gained more than $17 billion in adjusted gross income from the basket-cases of California, Illinois, New York, and New Jersey alone. New Hampshire has gained from all but one of its northeast neighbors, taking in nearly $6 billion from Massachusetts, New York, Connecticut, New Jersey, and Vermont. This trend continues nationwide as evidenced by the data.

Clearly, people are not moving from California to Texas or from Vermont to New Hampshire because of the weather. A single 35-year-old with no dependents earning $50,000 a year would save more than $1,800 a year in state taxes by moving from California to Texas. The same person would save nearly $2,000 a year in state taxes just by moving across the border from Vermont to New Hampshire. She would also be gaining greater fiscal reliability, and, most importantly, greater economic opportunity.

While other policy questions such as the regulatory environment and labor law make a significant impact, one thing is clear: Taxes matter for economic growth. That’s a lesson lawmakers in Washington would do well to learn from the laboratories of democracy and keep in mind as they tackle the test of federal tax reform.

Akash Chougule (@AkashJC) is a contributor to the Washington Examiner’s Beltway Confidential blog. He is the director of policy at Americans for Prosperity.