Eurogroup of finance ministers agree to endorse a new ‘contingency package’

By Suzanne Lynch, Irish Times

Discussions on new debt relief measures for Greece will commence as early as next Thursday, as the eurogroup of finance ministers agreed to endorse a new ‘contingency package’ for Greece.

Announcing a breakthrough in the Greek bailout talks in Amsterdam, eurogroup chairman Jeroen Dijsselbloem said finance ministers had agreed that Greece will have to present a series of contingency measures equating to 2 per cent of gross domestic product (GDP) which would be triggered in the event that Athens misses its targets in 2018, in order for the latest bailout review to be completed.

This would be in addition to a set of reforms already agreed under the terms of the third bailout.

An extraordinary eurogroup meeting of finance ministers has been provisionally scheduled for next Thursday in Brussels to discuss the imminent conclusion of Greece’s first bailout review, almost six months after it was scheduled to conclude.

Greek bond yields have fallen following the euro group meeting.

While eurogroup chairman Jeroen Dijsselbloem said that no nominal debt writedown for Greece would be sanctioned, other debt relief measures would be explored, including debt re-profiling, maturity extensions and grace periods.

The IMF and Greece’s EU lenders have been deeply divided about the question of debt relief for Greece since the agreement of an €86 billion bailout programme for the country last summer, following months of acrimonious negotiations.

While the Washington-based fund has demanded debt relief as a precondition for its involvement in the third Greek bailout programme, a number of euro zone countries, including Germany, are wary of granting significant debt relief measures to the bailout country.

Minister for Finance Michael Noonan was not in attendance at the meeting due to ongoing negotiations on government formation, with Minister of State Dara Murphy representing Ireland in Amsterdam.

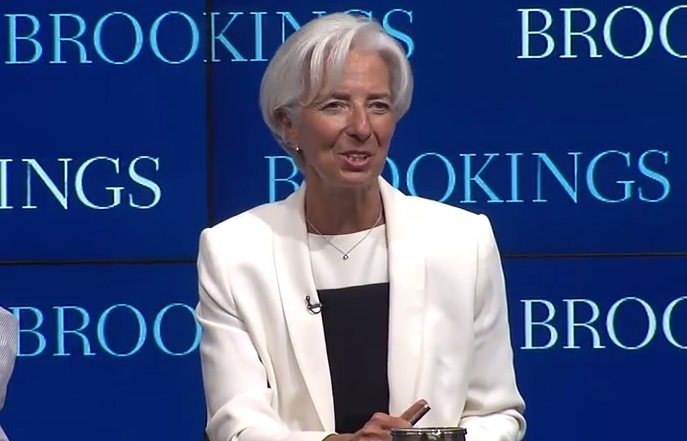

IMF managing director Christine Lagarde said that while agreement on the debt terms and conditions was needed in the next few days or weeks, the implementation of the debt measures could take longer.

“There is still a level of contingency,” the IMF chief said.

EU leaders agreed to consider further debt relief for Greece, if necessary, when they agreed on a third bailout programme for Greece last July.

Benoit Coeure of the European Central Bank said the bank remained on standby for technical assistance on debt relief measures for Greece, adding that the ECB agreed that “debt measures for Greece are necessary to ensure debt sustainability.”

He said the bank also welcomes the progress that has been made on tackling the problem of non-performing loans during the recent bailout negotiations.

In terms of the extra “contingency measures” demanded by the institutions before sign-off on the first bailout review could be given, Ms Lagarde said these measures would “have to be legislated upfront, have to be credible, and have to be triggered with a degree of automaticity” that would not leave room for interpretation.

Klaus Regling, the head of the euro zone’s rescue fund, the ESM, said he was hopeful that agreement on the extra contingency measures could be reached in the next few days before the planned eurogroup.

While he said that debt relief measures for Greece would then be considered, he sounded a cautious note, warning that, despite recent positive economic data on Greece, “the future is uncertain.”

He noted in particular Greece’s danger of accumulating domestic arrears again.

Greece’s plea for further debt relief was given a boost by eurostat data on Thursday which showed that the country attained a primary surplus of 0.7 per cent in 2015, well ahead of a target of 0.25 per cent.

“Greece, which has a primary surplus of 0.7 per cent does not need extra measures. What Greece needs is an essential debt relief,” the Greek Prime Minister Alexis Tsipras said ahead of Friday’s eurogroup.

While IMF Managing Director Christine Lagarde welcomed the surprise eurostat figures, she cautioned that the figures needed to be confirmed.

“I welcome the new numbers,” she said. “I think that they will change perspectives if they are accurate,” warning that budgetary data often have to be reviewed significantly.