By Wall Street Journal

If a week is a long time in politics, then the 20 months within which Greek Prime Minister Alexis Tsipras has said he wants to return his country to capital markets looks like an eternity.

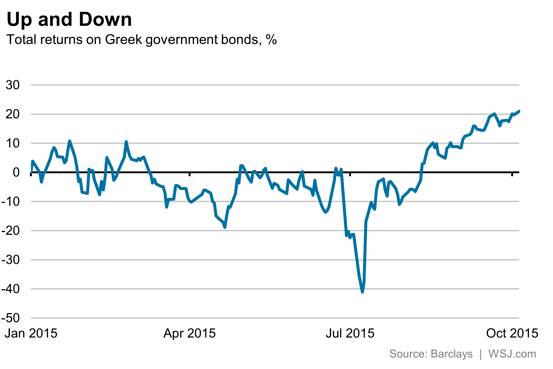

Greece has already returned to markets once before, of course. In April 2014, investors proved willing to buy newly issued Greek bonds just two years after the government restructured its debt. But the 18 months since that first issue hit the market have proved a wild ride for Greek bond prices. Two elections, a referendum on austerity and a nailbiting series of summits to secure a new bailout and prevent Greece exiting the euro have tested investors, in particular this summer.

On a year-to-date basis, Greek bonds are the best performers in Europe, up nearly 21%, according to Barclays index data. On a three-month basis, they have provided a startling total return of 53.7%. But on a 12-month basis, Greek bonds are actually among the poorest performers, down 1.7%. That range of returns speaks to the volatility investors have been faced with.

Of course, Mr. Tsipras might get some help yet. If Greek government bonds were to qualify for purchases by the European Central Bank, that might provide significant support in returning Greece to the market. Time might not be the only great healer for Greek bonds.