by Benn Steil and Dinah Walker, Council of Foreign Relations

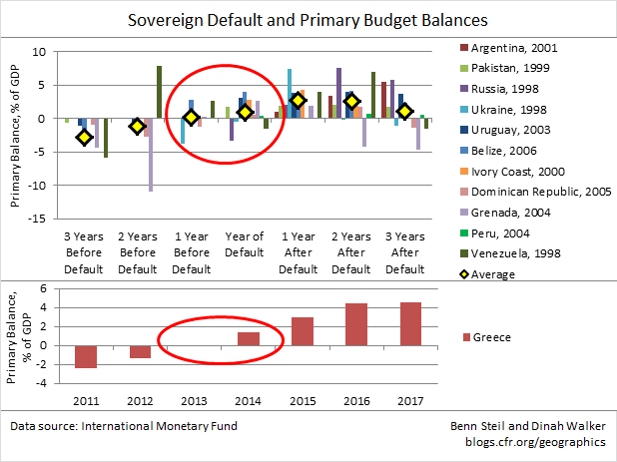

Things are looking up in Greece – that’s what Greek ministers have been telling the world of late, pointing to the substantial and rapidly improving primary budget surplus the country is generating. Yet the country’s creditors should beware of Greeks bearing surpluses.

A primary budget surplus is a surplus of revenue over expenditure which ignores interest payments due on outstanding debt. Its relevance is that the government can fund the country’s ongoing expenditure without needing to borrow more money; the need for borrowing arises only from the need to pay interest to holders of existing debt. But the Greek government (as we have pointed out in previous posts) has far less incentive to pay, and far more negotiating leverage with, its creditors once it no longer needs to borrow from them to keep the country running.

This makes it more likely, rather than less, that Greece will default sometime next year. As today’s Geo-Graphic shows, countries that have been in similar positions have done precisely this – defaulted just as their primary balance turned positive.

The upshot is that 2014 is shaping up to be a contentious one for Greece and its official-sector lenders, who are now Greece’s primary creditors. If so, yields on other stressed Eurozone country bonds (Portugal, Cyprus, Spain, and Italy) will bear the brunt of the collateral damage.

Financial Times: Greece Defies EU As It Begins Parliamentary Debate on 2014 Budget

IMF: Default in Today’s Advanced Economies: Unnecessary, Undesirable, and Unlikely

The Economist: Greece’s Bail-Out: Little Respite

Wall Street Journal: EU Week Ahead