Republicans believe everything is falling into place for the first major tax overhaul since 1986

Can Trump stay on track on tax reform?

By BERNIE BECKER and AARON LORENZO

For now, top congressional Republicans essentially are saying they will deal with any Trump outbursts on taxes when and if they happen.

Congressional Republicans are readying themselves for a new obstacle on tax reform: President Donald Trump and his penchant for disruptions.

There’s no doubt that Trump badly wants a tax deal, and he appears very willing to travel the country in support of one. But the GOP lawmakers that are crafting the tax measure are also bracing themselves for the president to potentially disturb their negotiations at any moment, as he has done throughout his nine months in office and this week on a bipartisan Senate agreement to shore up Obamacare insurance markets.

“Sure, it’s going to come,” said Sen. Bob Corker (R-Tenn.), who’s been the target of his share of tweets from the president.

Sen. Lamar Alexander (R-Tenn.), who brokered the health agreement that Trump has shifted between criticizing and praising, added that he had already told the president that his staying on track on tax reform could be key to getting a landmark achievement.

“If the president of the United States focuses on one thing, with everything he’s got, for as long it takes, he can usually get what he wants,” Alexander said.

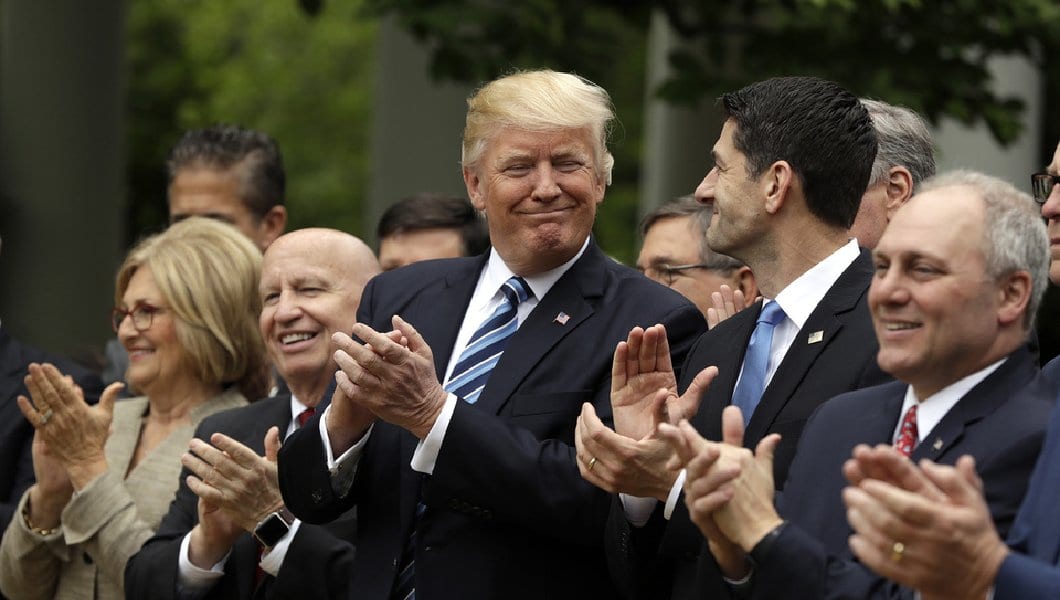

Republicans believe everything is falling into place for the first major tax overhaul since 1986. They control Congress and the White House, members are motivated to notch a big legislative victory they can campaign on in 2018 and they are on the cusp of a bicameral budget agreement that would allow them to concentrate on a tax package instead of the Senate passing a budget.

But there are already signs that Trump could waver if a tax bill proposes to cut tax incentives in exchange for lower rates, a difficult process that could end up raising taxes on various industries or groups of taxpayers. The president was reportedly not happy that the GOP proposal to end the deduction for state and local taxes, a benefit largely used by upper-income taxpayers, would also hurt some in the middle class.

Republicans have started to scale back their ambitions on the state and local deduction, and are now looking at ending it only for top earners instead of fully repealing it.

And while GOP lawmakers want as much control as they can get over actually writing a tax bill, Trump has left little doubt that he’ll be willing to lash out at them if they struggle or fall short.

“We’re not getting the job done. And I’m not going to blame myself, I’ll be honest,” Trump said Monday about Republicans’ problems passing key legislation. “They’re not getting the job done,” the president then added.

Those dynamics have left tax lobbyists worried that Trump could further complicate the GOP’s work on overhauling the tax code, an issue already so difficult that it last happened more than three decades ago.

Trump also seems to have a penchant for reopening issues that top lawmakers and administration officials negotiating the plan thought had long been settled.

At a White House meeting this week, the president prodded Republican and Democratic tax writers in the Senate to form a bipartisan working group on taxes. That’s an idea that’s been tried several times in recent years, and runs counter to the GOP’s months-long approach of going it alone on taxes.

On top of that, Trump himself had said just hours before that Democrats’ only interest on taxes was in raising them, and predicted they would do whatever they could to obstruct a tax bill. He repeated the criticism on Friday.

According to some attendees at the meeting, Trump also resurrected the idea of using revenue from tax reform to finance a massive infrastructure program, something other Republicans took off the table months ago.

It’s far from the first time that the president has surprised his GOP allies on the Hill in areas where they were working together. Perhaps most famously, Trump celebrated the passage of the House’s Obamacare repeal bill, then called it “mean” a couple months later, just as the Senate was gearing up to tackle the issue.

For now, top congressional Republicans essentially are saying they will deal with any Trump outbursts on taxes when and if they happen.

Senate Majority Whip John Cornyn (R-Texas) and other GOP tax writers quickly brushed aside the idea of a new bipartisan tax working group this week, arguing that Congress already faced a time crunch in getting a bill to Trump’s desk.

“We need to focus on the budget resolution and taxes,” Cornyn said on Thursday, hours before the Senate passed a budget that would allow them to pass a tax plan without Democratic support.

“Keeping focused on that I think is the most important thing we can do right now,” Cornyn said.

Senate Republican leaders later struck a deal with their House counterparts that would allow both chambers to consider a tax bill more quickly, though neither side has released legislation yet.

That left Senate Republicans ready to redouble their efforts on the most difficult aspects on taxes, like exchanging cherished tax breaks for lower rates.

The challenge ahead for tax writers is “actually coming up with” $4 trillion worth of tax breaks to eliminate, Corker said. “Otherwise, we don’t have tax reform.”

GOP tax writers are expecting to shoulder most of the work of converting the tax framework that Republican leaders negotiated with senior administration officials into legislation.

Trump and his team don’t seem to have any issue with that approach, at least not yet. The president’s key focus on taxes has been getting the corporate tax rate down from 35 percent to 20 percent, according to key lieutenants, like Treasury Secretary Steven Mnuchin, and outside activists who have met with him.

Gary Cohn, director of the National Economic Council, said this week that ensuring a tax package that benefits the middle class was the only other area in which the president wasn’t willing to compromise, while also suggesting the administration would take a more hands-off approach while Congress worked its will.

“Everywhere else, we are more than flexible when working with the Senate and the House in the way they’re going to write the new legislation,” Cohn, who negotiated the so-called Big Six framework along with Mnuchin and Hill GOP leaders, said at an event hosted by the American Bankers Association.

Lawmakers and tax observers say there’s also some reason to believe that Trump could inject less uncertainty into the tax process than he has on other issues.

By all accounts, Trump is more engaged and knowledgeable on tax issues than he was about the Affordable Care Act during Republicans’ effort to topple it, and he’s also well aware that the GOP needs a legislative victory before facing voters in the midterms in little over a year.

“So far, the president’s team has been working for months with members of the Finance Committee, with the leadership and have met with many of us,” said Sen. Susan Collins (R-Maine), while also seemingly acknowledging the tangles she and other Republicans have had with Trump on health care and other issues. “It seems to be on a steadier path. Let’s put it that way.”